Redefining and Revolutionizing

Wealth & Finance

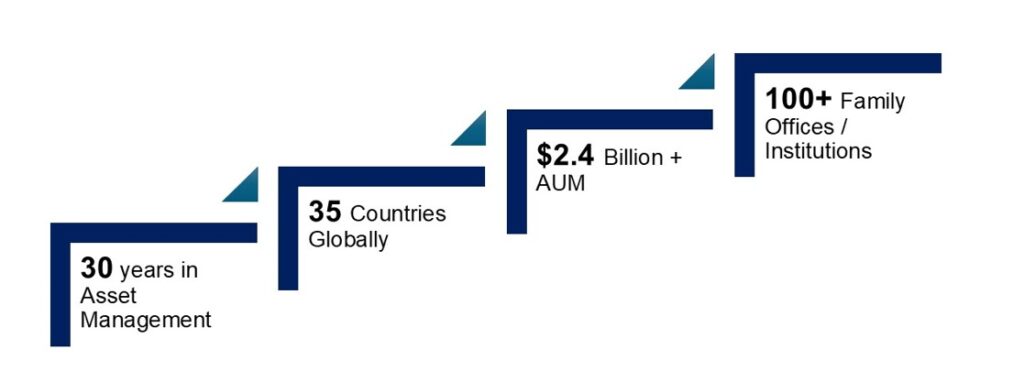

Pace 360 is a Macro Top-Down focused asset management company co-founded by Amit Goel and Atul Goel. We are pioneers and industry leaders in the Macro-Top Down, Multi-Asset theme of fund management in India and manufacturers of some of the best performing PMS and AIF funds in the country. Our firm caters to HNIs, UHNIs, Family Offices, and Corporate Treasuries in India and globally, managing an AUM of nearly $2.4 Billion. Pace 360 has a track record of more than two decades in generating superior risk adjusted returns which are uncorrelated with the rest of the industry across bull and bear markets.

Pace 360 is the Asset Management arm of Pace Group which was founded in 1995 by Amit Goel and Atul Goel. The group provides a wide range of financial services catering to the investment needs of the customers, maintaining offices in 75 cities across India with customers in 34 countries.

Our Approach

Research Driven

Proprietary research is the foundation of our investment approach. Our experienced team of more than 10 analysts collaborate on integrating knowledge across regions, sectors and asset classes to arrive at uniqueand valuable insights.

Diversification & Risk Management

Risk management is fundamental to our portfolio construction. We monitor all our portfolios to ensure a balanced risk-return profile and invest in complementary performance drivers, keeping a global view of portfolio risks at all times.

Adaptation to Client Objectives

Client needs are unique and ever-changing. Tailored to meet diverse requirements- low volatility solutions, risk management strategies, capital growth objectives. Our multi-asset solutions is crafted to meet distinct risk-return goals.

Our Milestones

Our Offerings

Awards & Recognitions