Portfolio Management Services (PMS)

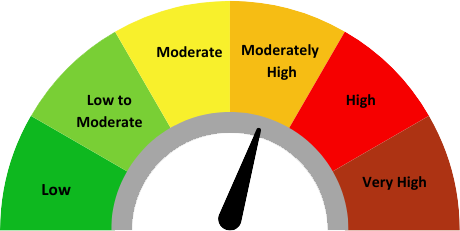

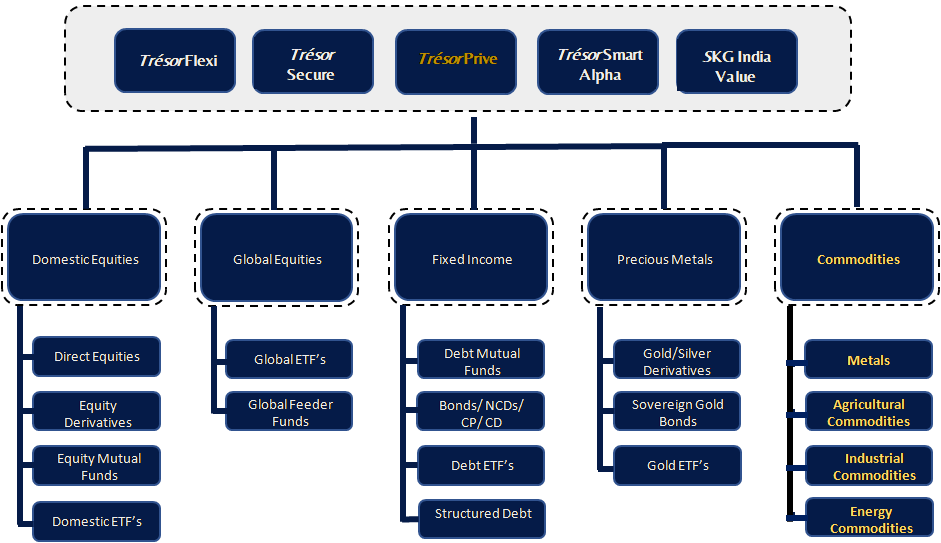

Pace 360 Multi-Asset PMS is a distinctively designed combination of various asset classes in Global & Domestic securities such as fixed income, equities, precious metals & commodities. Our strategies generate a healthy alpha in a portfolio and intend to strive hard to meet all the financial goals of the investor. We tailor the product completely in accordance with the risk-return profile of the investor and the stated preferences.

Our Competitive Edge

Our multiple PMS strategies are highlighted by PMS Bazaar & PMS AIF World as the top performing schemes in the country across all categories and time frames.

- A True Multi-Asset PMS, first of its kind in the country using the macro top-down approach

- Portfolio returns are uncorrelated with any single asset class or vis-à-vis other PMSs in a similar category

- Low correlation with your existing portfolio will add to the diversification

- Portfolio volatility is lower than that of a single asset class

- No restriction on minimum exposure in an asset class during a market correction

- We have ample skin in the game

- Higher hurdle rate than the industry peers

- Ample liquidity is always available

PACE 360 PMS Strategies

Disclaimer: Investors should consult their financial advisers if they are not clear about the suitability of the product.

Universe of Financial Instruments

Meet our PMS Key Management Team

AMIT GOEL

Co-Founder & Chief Global Strategist

PANKAJ GOEL

CEO – Asset Management

SHAH NAWAZ

Compliance Officer

ONBOARD WITH US TODAY

Kindly submit your details, our Relationship Manager will get in touch with you, or reach out to us at