All that is Gold “Glitters”

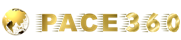

The outlook is extremely positive right now and we believe it represents one of the best long term investment opportunities. There are enough macro indicators which support the case for investment into gold and we have pointed out many such factors in our previous macro insights and outlook reports. However, this macro insight is dedicated to the technical aspects of gold as an asset class. We would want to draw your attention to how tremendously under-invested gold is at the moment. The gold ETF holdings are at their lowest in more than four years and have seen redemptions in gold ETF to the extent of almost 30% from the peak made in 2020. We have had net redemptions for 8 consecutive quarters which has never happened before in history. The highest number of quarters before this was 4 in 2013 followed by 3 in 2015.

The chart above shows how these periods presented a great short term to long term opportunity to buy gold. In fact, the multi-year low of USD 1032 per troy ounce was made in December 2015 which was at the end of one such period. Now with 8 consecutive quarters of net redemptions we feel gold is about to take off and we expect it to reach 2400 levels by year end and a level of 5000 plus by 2027.

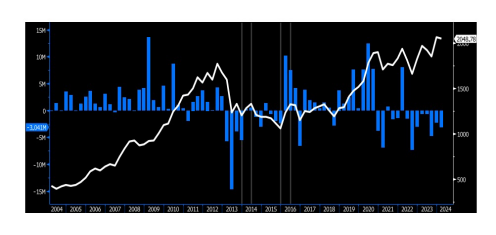

Apart from the gold ETF, we can see from the chart below that the open interest in gold is also extremely low. Whenever the open interest has been this low in last few years, we have seen a rally in gold price soon after. We see the history repeating itself this around as well.

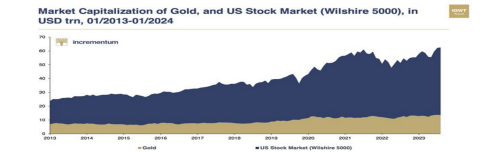

The charts below show how gold has severely underperformed equities as an asset class over the last few decades. We see the Gold/S&P500 ratio going up from its current abyss in a big way over the next few years. This could be accentuated with gold prices going up and with equities going into a bear market which is also our macro call for the next 3-4 years. However, equities going down is not a pre-condition for gold to go up. Some of the many stunning gold rallies have happened in an equity-bullish macro drop like in 2001-2008. At the same time some of the breath-taking rallies have happened during an equity bear market like in 1973-1979.

Conclusion

Gold is at the cusp of a multi-year bull run that could see it going up 2.5-3 times over the next few years. All the global macro-fundamental factors are pointing towards the stunning potential of this asset class over the next few years and all our technical indicators tell us that this may be about to take off very soon. So, it’s probably time to get on board and sit tight.

Comments are closed.