At the Crossroads: Global Markets Poised for Recovery

The recent performance of global financial markets has been marked by heightened volatility and a pronounced risk-off sentiment. This report delves into key market indicators, including the Dollar Index and VIX, and outlines our near-term outlook, highlighting opportunities in global equities, particularly in emerging markets and Indian equities, as the stage is set for a significant rebound.

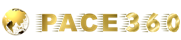

The chart above illustrates the Dollar Index Spot (DXY) performance over a specified period, highlighting a consistent upward trend from late September to mid-November, signalling a strengthening U.S. dollar. Following a brief November dip, the index rebounded, reaching its peak in December. The sharp December rise suggests impactful market factors, such as economic reports or central bank actions.

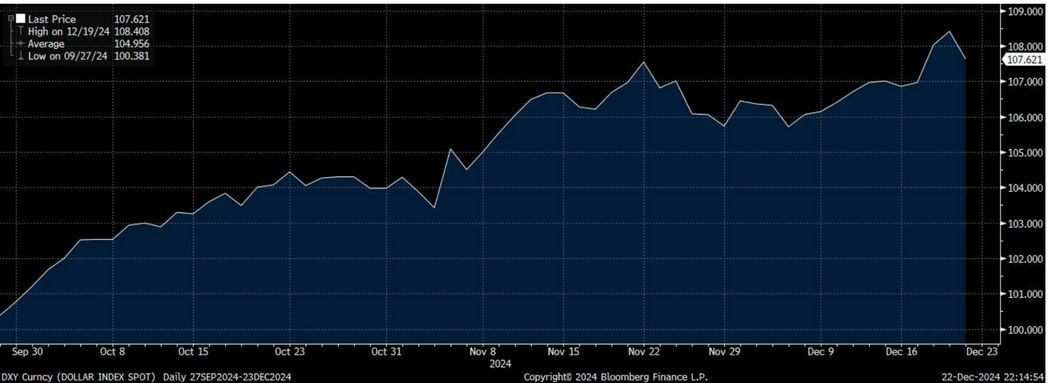

The chart represents the historical performance of the S&P 500 (SPX) index following significant spikes in the CBOE Volatility Index (VIX). The VIX, often referred to as the “fear index,” measures the expected volatility of the S&P 500 over the next 30 days. The fluctuations highlight the dynamic nature of investor fear and its sensitivity to various economic, political, and geopolitical factors. A sudden increase in the VIX typically indicates heightened fear and uncertainty in the market. As of December 20, 2024, the VIX closed at 18.36, down 23.79% from the previous session. While this level reflects elevated caution, the sharp decline from recent highs suggests a reduction in fear, indicating that markets may be stabilizing. Historically, when the VIX begins to recede after a sharp spike, equity markets often find their footing, creating opportunities for recovery.

Navigating the Inflection Point: The Road Ahead for Financial Markets

Global equities had a disastrous week with US equities going down sharply and EM equities continuing their string of losses well into the second half of December. In the aftermath of a hawkish FED this week, there was a massive spike in US Vix and the Dollar Index accentuating a huge Risk-off scenario in all risk assets of the world. We see a huge inflection point in the financial markets at this point. We believe global equities have bottomed out and are headed for a bull run over the next 5-6 weeks. We see EM equities outperforming US equities in this global rally as they have become deeply over-sold after a devastating quarter so far. We believe Indian equities will be one of the top-performing over the next 5-6 weeks as they have witnessed the worst selling from Flls this quarter. With Flls now expected to become more benign for EMs and particularly for India, there should be a massive rebound in Indian equities. We expect the Dollar Index to correct close to 105 levels by January end. We also expect the US bond yields to soften a bit by then.

Comments are closed.