Introduction

The Indian economy is currently on a slower growth trajectory than initially expected for CY 2024. Both the Reserve Bank of India (RBI) and several global financial institutions have lowered their growth forecasts for the country. The health of the banking sector is a critical indicator of the broader economy, reflecting the intricate interplay between economic growth, bank credit growth, deposit growth, and interest rate spreads. Analyzing these dynamics provides valuable insights into how well the banking sector is supporting economic growth and how shifts in these metrics may signal broader economic changes.

Real GDP and Real GVA: Assessing India’s Economic Health

India’s GDP growth in Q1 FY25 is anticipated to be around 7%, a decline from the 8.2% growth recorded in Q1 FY24. The Reserve Bank of India has already adjusted its growth forecast downward due to factors such as a contraction in government capital expenditure and reduced corporate profitability.

A concerning trend is that the Real Gross Value Added (GVA) growth rate has consistently lagged behind the real GDP growth rate. The trend line shows that Real GVA began underperforming compared to Real GDP from Q3 FY23 onward. Since then, the Real GVA growth has declined more sharply, signaling a potential fall in the Real GDP growth rate in the coming quarters.

Indicators for Real GVA:

- Manufacturing GVA: This indicator has experienced a dip due to lower industrial output growth, coupled with higher staff costs, leading to weaker profit margins for India Inc. This, in turn, exacerbates the decline in growth for the manufacturing sector.

- Corporate GVA: Corporate GVA declined to 10.9% in Q1 FY25, down from 26% in Q3 FY24. Additionally, the aggregate EBITDA margin witnessed a sharp decline of around 100 basis points for the corporate sector.

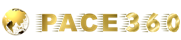

Bank credit growth has slowed down significantly, contributing to the decline in Real GVA. Anemic credit growth is often a precursor to a decline in private sector capital expenditure (Capex), which could eventually lead to a full-fledged economic slowdown.

From a global Macroeconomic perspective, factors such as a slowing global economy, geopolitical risks, uncertainties, and supply chain disruptions are also influencing the decline in Real GVA growth.

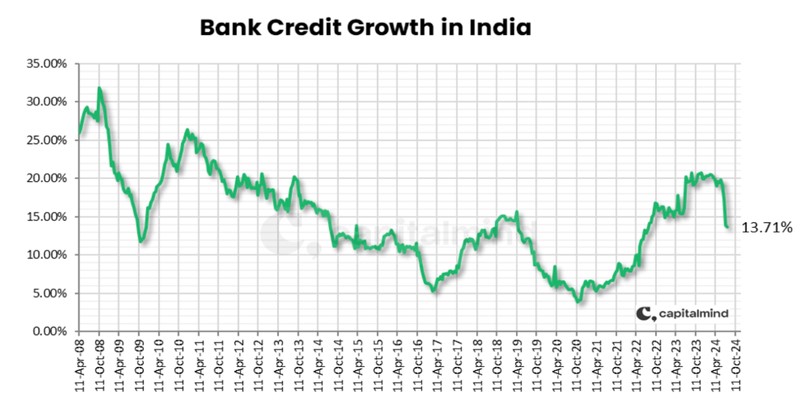

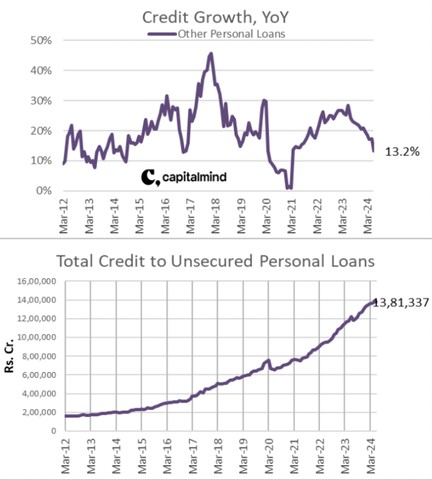

Bank Credit Growth: Rising Caution in Lending Practices

The above graphs shed more light on the credit expansion in India over the last decade or so. The household and personal loans component has skyrocketed over the last decade which has attracted attention of the Indian regulators. Apart from the massive rise in personal loans, a huge rise in NBFC credit over the last decade also throws open the possibility of systemic risks that may crop up over time.

Factors Contributing to a Decline in Bank Credit Growth:

Increased Deposit Costs: To fund loan growth, banks must now pay more for deposits, posing a significant challenge for managing net interest margins and overall profitability. Increased Risk Weights: The RBI’s increased risk weights on consumer credit exposure, particularly for unsecured loans from both banks and NBFCs, has slowed unsecured loan growth to 18% in 2024, down from 23% in 2023.

- Slowed NBFC Lending: The share of unsecured loans in the overall NBFC loan offering declined to 22.9% in March 2024, compared to 32.2% a year ago. Retail lending by NBFCs also moderated to 14.8% growth in March 2024, down from 16.6% a year earlier. With NBFCs being the largest net borrowers from the banking system, the sector had gross liabilities of approximately Rs 16.58 trillion as of March, underscoring the potential risks to financial stability.

The impact of a slowdown in credit growth on economic activity is further driven by tightening liquidity and heightened caution in lending which could restrict economic activity, posing a challenge to sustained growth.

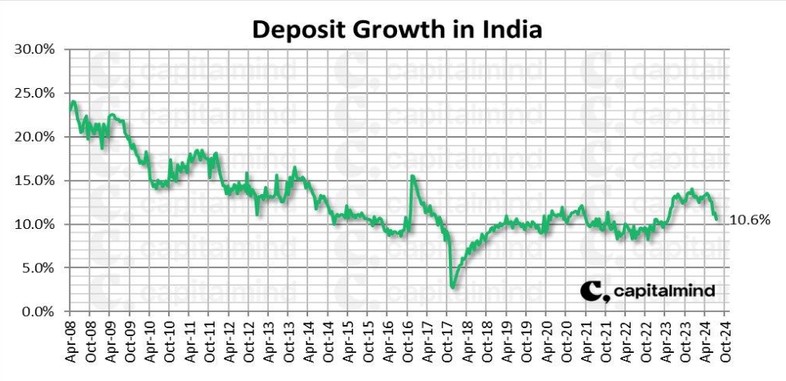

An overall sluggish bank deposit growth adds to the worries of banks. Banks have been struggling to raise deposits vis-à-vis the growth in credit and cheaper deposits are henceforth becoming more difficult to come by. The majority of household financial assets are still in bank deposits, although this proportion has been dropping as more and more consumers allocate their savings to mutual funds, insurance funds, and pension funds.

Cheaper deposits are critical for banks to manage their cost of funds. Looking at the current and savings accounts (CASA) data of the banking sector, it suggests that the ratio of cheaper deposits to the overall deposit book is falling. This fall is also because of the widening yield differentials between the savings rate and other short-term money market instruments where investors can easily earn a higher yield without compromising on liquidity. Hence depositors and small businesses are now preferring to park their money in money market funds as opposed to banks leading to a further decline in bank deposits in India.

Narrowing Interest Rate Spreads: A Challenge for Bank Profitability

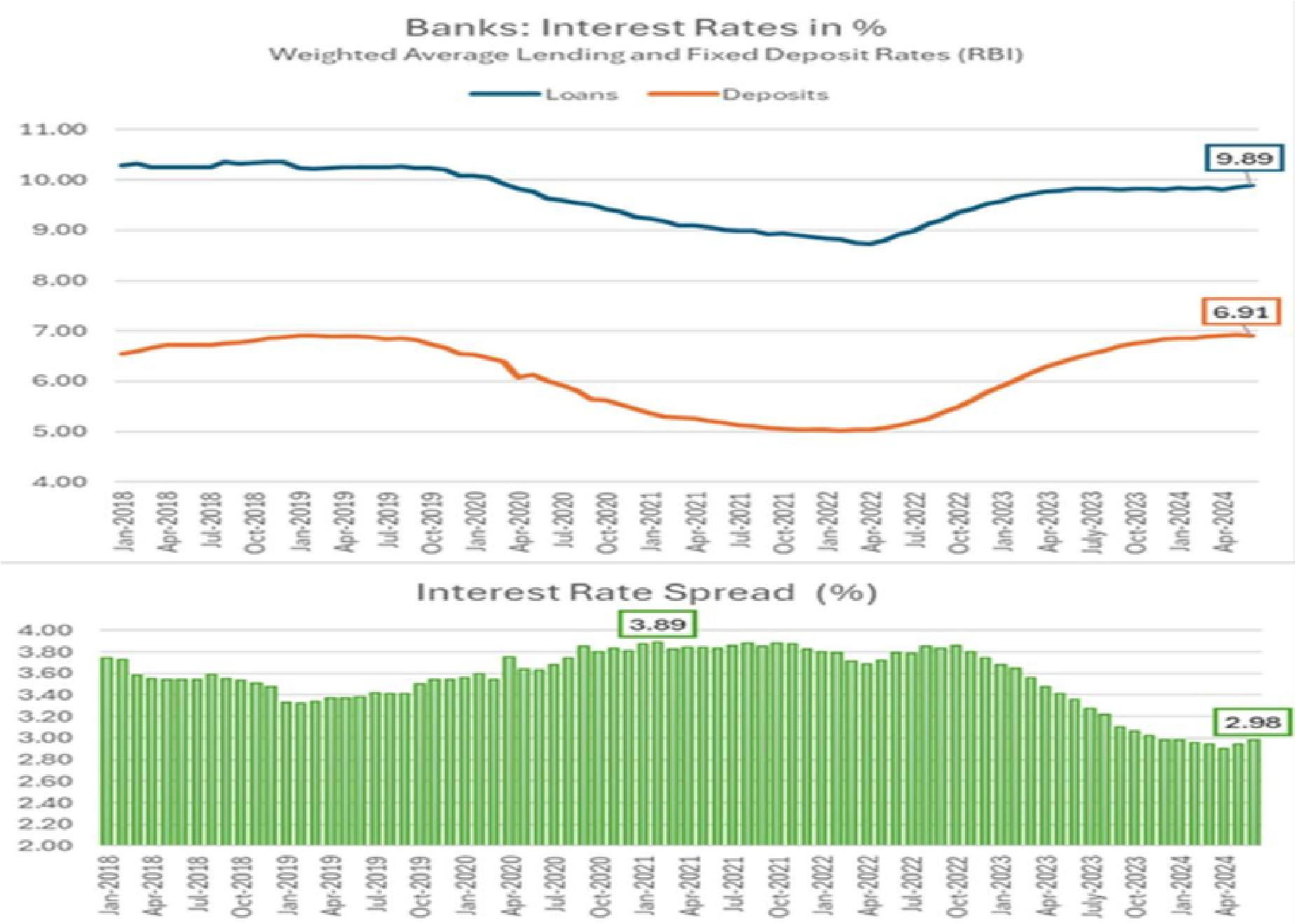

The trend in loan rates has been generally downward, with a significant drop between late 2018 and early 2020. Since then, rates have remained relatively stable with slight fluctuations. Conversely, deposit rates have been increasing as banks compete with each other and with alternative investment avenues, leading to a sharp fall in net interest margins (NIMs).

Interest Rate Spread: The interest rate spread—the difference between the interest charged by banks on loans and the interest paid to depositors—has been narrowing in recent years. This trend, driven primarily by an increase in deposit rates relative to lending rates, has negative implications for bank profitability, as narrower spreads can reduce margins.

The overall impact of narrowing spreads on the banking sector in India poses a potential headwind for the Indian economy. The current state of the Indian credit market is not particularly conducive to the future health of the economy.

Conclusion

There is a lot going in favor of the Indian economy and the Indian stock markets in a world where there are so many economic and geo-political hotspots. However not all is well with the Indian economy either. The state of the Indian banking and financial sector is certainly a bit worrying from an economic standpoint. The falling credit growth paints a bleak picture for Private sector Capex and a much more indebted household sector is not the best omen for rise in the Private consumption. With government Capex and Infra spending growing slower than the previous years the numbers simply do not add up for a robust GDP growth in India over the coming quarters. With a slowing corporate earnings growth, the stock market exuberance seems quite out of place. We suggest that investors should recognise these headwinds while making their financial and investment decisions. A healthy dose of financial conservatism at this point will probably stand investors in good stead over the next 2-3 years.

Comments are closed.