Inflation and Growth: RBI’s Delicate Dance Amid Food Price Surge

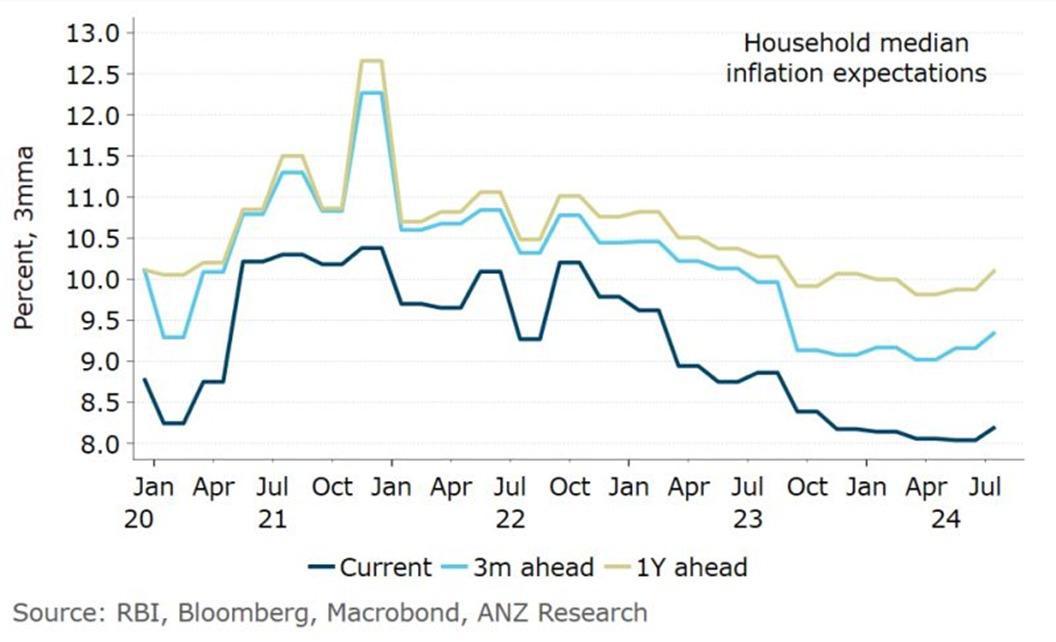

The RBI’s shift from a withdrawal of accommodation to a neutral stance signals a significant change in its approach, paving the way for potential monetary easing in the near future. However, despite this change, the central bank remains vigilant about persistent inflation risks, particularly from food prices and rising household inflation expectations.

An analysis of the current inflation dynamics and the potential policy implications:

1. Household Inflation Expectation

-

- Inflation Expectations Stubbornly High: Although inflation has been on a broader downtrend, household expectations of inflation are no longer falling. This signals that even as headline inflation cools, the perception among consumers is that prices remain elevated or will continue to rise, driven by persistent increases in food and energy costs.

- Second-Round Effects: The RBI has been cautious about these second-round effects. When households expect prices to remain high, it can impact wage-setting behavior and price-setting by firms, which could lead to a sustained increase in core inflation (the non-food, non-fuel component).

2. Food Inflation Pressures

-

- Base Effect & Food Price Volatility: The anticipated headline inflation of 5.21% for September, a significant jump from 3.65%, is largely due to base effects and rising food inflation. The sharp rise in prices of essentials like tomatoes, garlic, and cooking oil has been a key driver. The return of food inflation pressures adds complexity to the RBI’s task, as sustained food inflation can feed into broader inflation expectations.

Conclusion

The central bank is likely to take a cautious approach, waiting for more clarity on inflation trends and household expectations before embarking on a rate-cutting cycle. The situation is fluid, and the RBI’s balancing act between inflation control and growth support will remain in focus in the coming months.

Comments are closed.