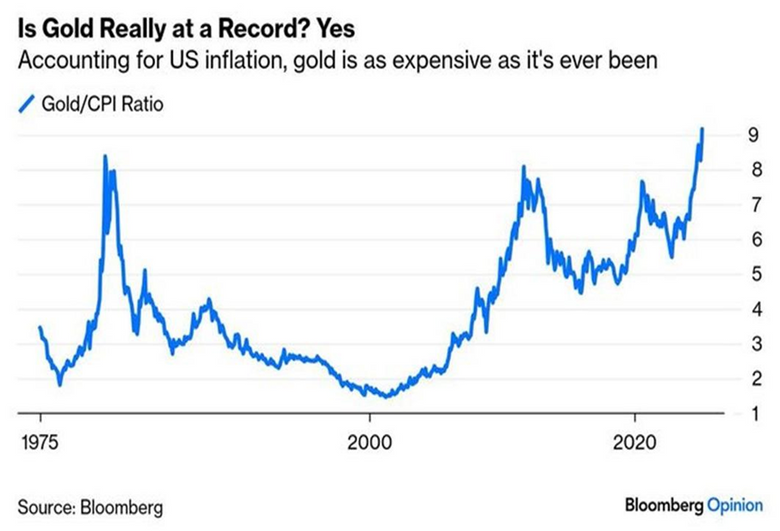

Is Gold Really at a Record?

Gold is widely recognized as a reliable hedge against inflation, helping investors preserve their purchasing power over time. To assess its long-term value retention, its nominal price is often adjusted for the Consumer Price Index (CPI). The chart above highlights that the Gold-to-CPI ratio is currently at its highest level in history. Historically, whenever this ratio has surged significantly, it has been followed by a decline in gold prices over the near to medium term.

A notable example is the period from 1980 to 2001, when gold’s inflation-adjusted price fell by more than 80% after reaching a peak in early 1980. Similar trends were observed between 2012 and 2019, as well as from 2020 to 2023, reinforcing the pattern of price corrections following sharp increases in the Gold-to-CPI ratio.

Gold recently surged to an all-time high of $2,942 this week, reflecting a gain of over 10% since the start of 2025 and an impressive 43% increase over the past year. It has emerged as one of the best-performing asset classes in the current economic environment. The rally underscores growing concerns over global economic stability, inflationary pressures, and the broader implications of trade policies. While tariffs are intended to protect domestic industries, they also lead to higher costs, trade tensions, and potential retaliatory measures-factors that investors are closely monitoring. As a result, gold’s role as a safe-haven asset has remained strong.

However, the current market sentiment suggests that gold has become overextended, with excessive froth and an absence of sellers. Given that most participants are buyers at this stage, a correction appears necessary in the coming months. A decline toward $2,600 is expected, as gold was trading around $2,500-$2,600 levels in November. This presents a medium-term risk that could lead to increased volatility.

Historically, gold has undergone strong rallies following extended periods of consolidation and negative returns, as seen in past market cycles. Likewise, it has also experienced corrections after significant upward movements. This pattern indicates that a medium-term pullback may be likely, while remaining a strong long-term investment.

Looking ahead, we anticipate gold will continue its long-term upward trajectory, with new all-time highs expected over the next four to five years. In the long run, we project gold reaching $4,000, driven by macroeconomic trends and its continued appeal as a hedge against uncertainty.

Comments are closed.