Introduction

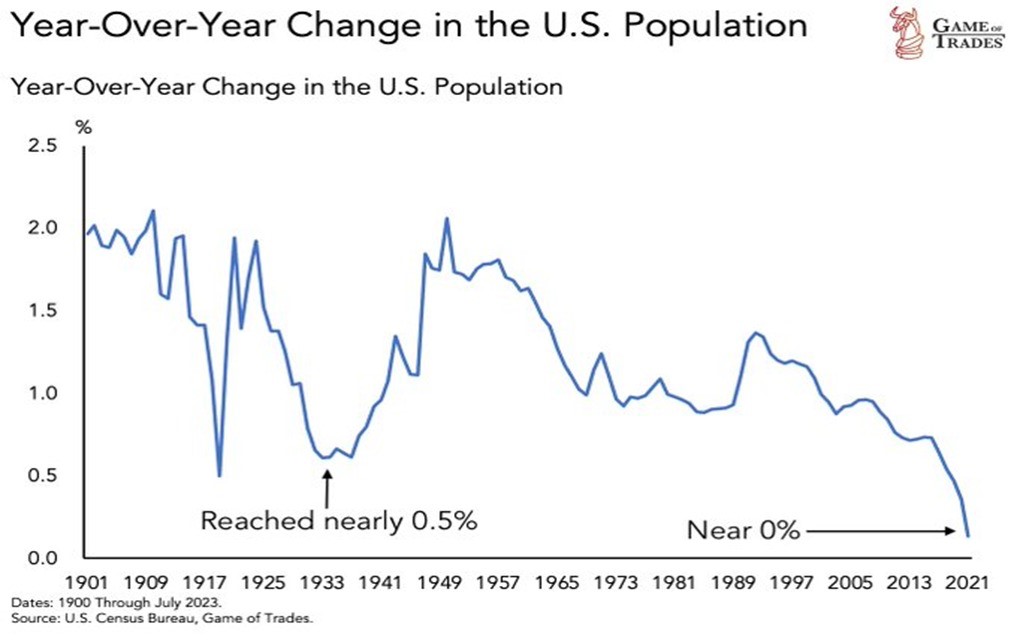

The chart above illustrates that the rate of change in the US population is approaching 0%, signifying a state of virtually zero growth. Such levels have not been observed in over a century.

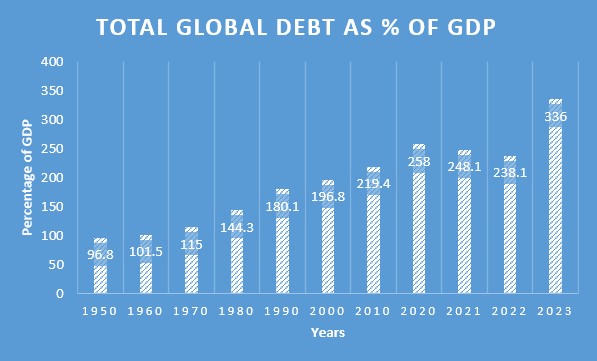

We believe that large parts of the world are currently exhibiting symptoms similar to Japan’s challenges in the late 1980s. These include declining or stagnating total and working-age populations, an economy burdened by debt, and bubbles in both the equity and real estate markets. This scenario is poised to significantly reduce the trend growth of the global economy, mirroring Japan’s experience over the past 34 years. Such a situation has serious implications for the world of investing, characterized by plateauing or falling equity markets, an increase in debt defaults, and a deflationary spiral. Consequently, there is expected to be a tremendous boost in returns from long-term local currency government bonds.

Comments are closed.