Introduction

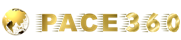

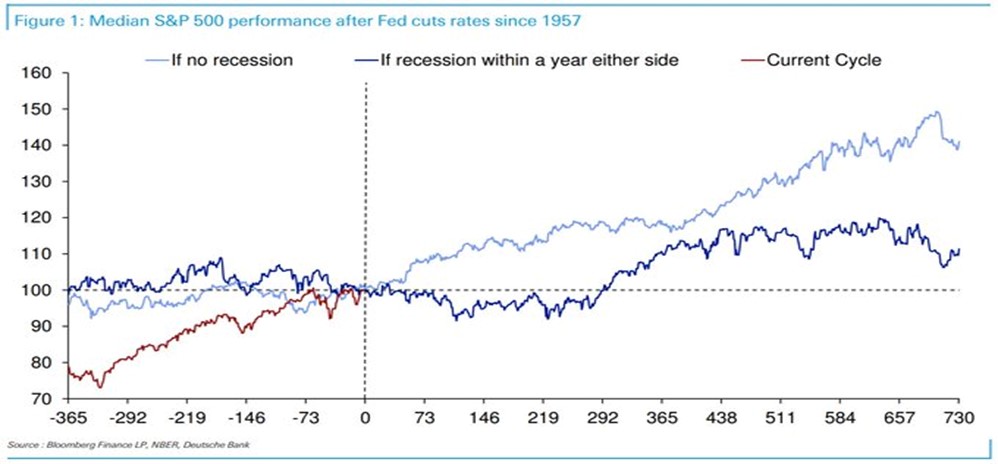

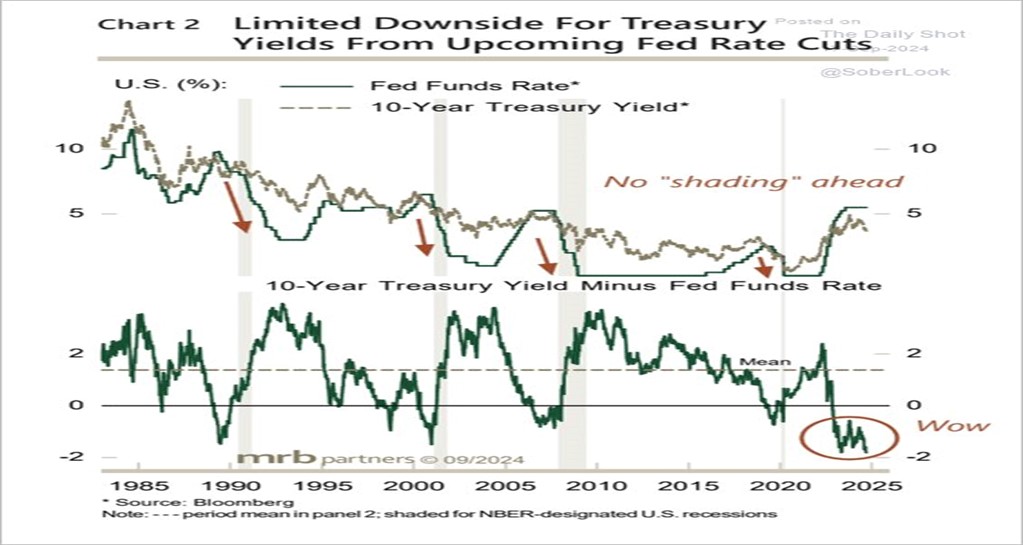

The Federal Reserve is expected to kick off a series of rate cuts on Wednesday, after having completed last year the most aggressive rate hike campaign in four decades. For investors, a key question may be whether the Fed will cut rates in time to avert a potential economic slowdown. It is pertinent to note the bonds do much better in rate cutting cycles which lead to a recession than they do in cycles which do not end in a recession. This is exactly the reverse from equities which tend to do well post the first rate cut only when it doesn’t turn out to be a recessionary cycle and actually go down post the first cut if it happens to be a recessionary cycle. This is also evident from the graphs given below which show how different asset classes react post the first FED cut. In fact, the only asset class that has been very consistent in its reaction to the beginning of the rate cutting cycle is the dollar index which has invariably made a bottom in the immediate aftermath and then gone on to rally hard post that. Refer to the graphs below that illustrate our findings.

Bonds have been a hugely rewarding bet for investors in the run-up to the first rate cut by FED. This is the reason why we at Pace 360 have been advocating investing in the 20-30 year GOI bonds for the last one year when it became evident that the hiking cycle is coming to an end.

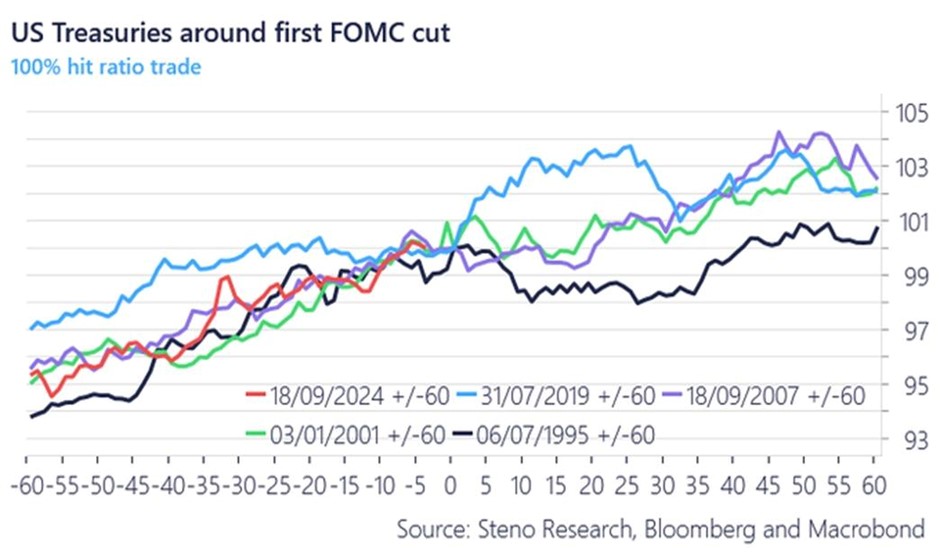

The chart below showcases the percentage change in US Treasury yields relative to their levels from 60 days before to 60 days after the first FOMC cut in the previous four rate cutting cycles of the last 30 years. It also depicts how the trend has fared this time around in CY 2024. One noteworthy aspect of the last 30 years of rate cutting cycles is that whenever bonds have rallied hard in the run-up to the first rate cut, they have become sideways to bearish post the FED cut; on the other hand when they have been sideways in the run-up they can be expected to rally post the cut. We believe that this time around, bonds have rallied a lot, particularly, in the last two months. Hence, we are recommending to our investors that one should reduce the duration before the FED decision tomorrow so that one can increase the same if the bonds go down or become sideways for an extended period. This is specially in the light of the fact that the carry is hugely negative in most fixed income markets including US and India. In case of Emerging Markets including India there will also be pressure from the rising dollar index which may exaggerate bond market underperformance.

Conclusion

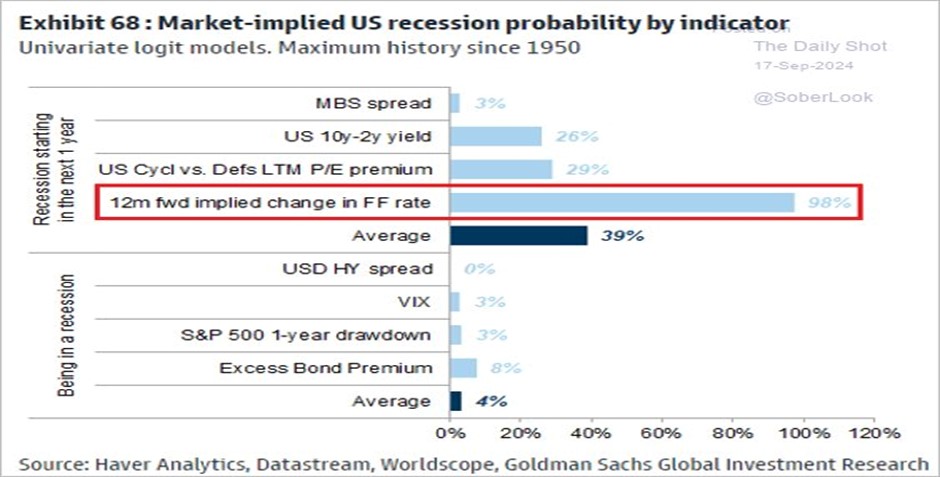

There is a huge disconnect playing out between the global equity markets and the global bond markets. While equities are betting on a soft landing, which is why they are at all time highs right now, the bond markets give a much higher probability of a US recession next year. This is why the bond markets are discounting 10 FED rate cuts by the same time next year. Please see the chart below that depicts the chances of a US recession based on different macro indicators.

While this debate and disconnect may take a few more months to get resolved, there is no doubt that bonds have rallied very smartly in the run-up to the first FED cut. Over the last 30 years, whenever bonds have rallied aggressively in the weeks before the first cut, they have become sideways to bearish in the immediate aftermath. Hence, we believe that one should book some profits and reduce the duration in US and in India before the FED meeting on 18th September, so that one can increase the net carry/YTM of the portfolio and then get back to long duration in case there is a correction in bonds or they become sideways for an extended period.

Comments are closed.