Introduction

Germany has been a very unique story over the last few years where their GDP and Industrial production has been in negative territory for many quarters and yet their stock market is making new all-time highs on a regular basis. The charts below point out how the two have diverged. The German economy is in its worst shape in a very long time and has been losing its key manufacturing industries to countries like China, Vietnam, and Mexico. This trend got particularly accentuated after the Russia-Ukraine war broke out in 2022 due to which many energy intensive industries had to close down and shift elsewhere. The EV revolution has also been a big setback for German industry as it lost ground to the US and then China. The German economy has been in a slowdown/ recession mode for many quarters now underperforming most developed countries in the post covid world. In such an abysmal backdrop, it is quite stunning to see German stocks doing extremely well and giving stellar returns over the last few years.

The graph reveals a positive correlation between Germany’s PMI composite output index and its GDP growth. Notably, recent data suggests a troubling trend. As Germany’s economy struggles with recessionary pressures, both GDP and PMI have been on a downward slope. This, based on the historical correlation, would likely lead to a continued underperformance by German industry and economy over the next many quarters.

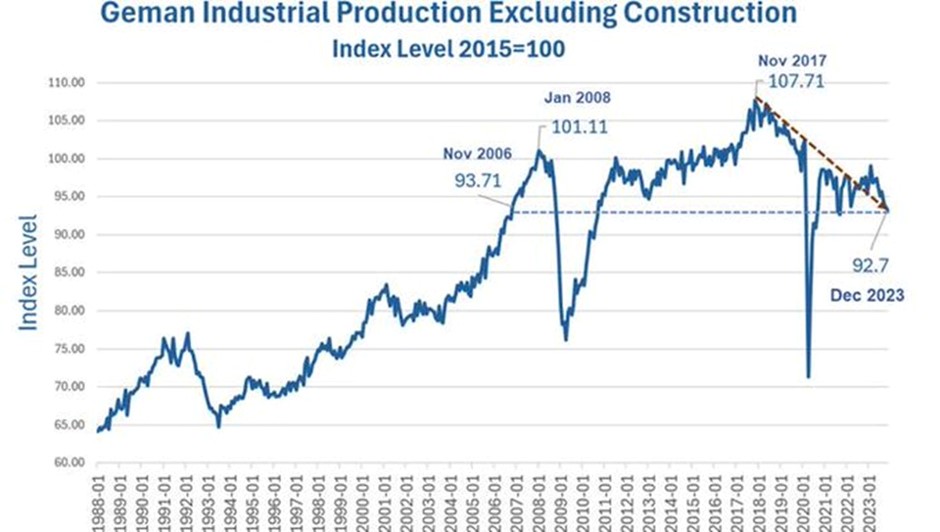

Germany’s Industrial Superpower Days Are Over

According to the graph above, the index level of German industrial production in December 2023 was around 92.7. This index was at around 108 levels back in November 2017 which clearly shows how the German economy has been left behind by the other leading Developed and Developing countries of the world. This is one of the worst ever underperformance by a leading economy of the world with only Japan as a parallel in modern history.

Given the above factors one would be forgiven for thinking that German stock markets would be one of the worst performing and would be significantly down from the all-time highs. On the contrary German markets have been absolutely one of the best performing equity markets in the developed world after the US.

Conclusion:

The stunning divergence between the German economy and the stock markets is yet another symptom of the classic bubble global equities are in. It shows how disconnected the current rally has got from the underlying fundamentals. There are many other such classic symptoms which reflect the broader malaise in the financial world today. This is certainly not going to end well even though the markets may remain buoyant in the near future.

Comments are closed.