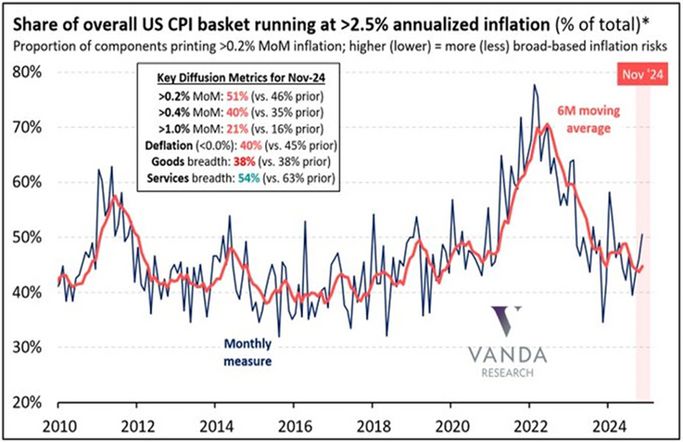

U.S. CPI Analysis: Persistence in Inflationary Pressures

Inflation remains one of the most critical variables shaping economic policy, corporate strategy, and financial market dynamics. For investors, understanding inflation’s breadth, persistence, and underlying drivers is essential for navigating an increasingly complex macroeconomic environment. The analysis of the U.S. Consumer Price Index (CPI) provides a lens through which we assess the extent of inflationary pressures across various categories of goods and services. By focusing on the proportion of CPI components experiencing annualized inflation above 2.5%, we aim to uncover critical trends that influence monetary policy and, ultimately, asset valuations.

Trends in CPI Inflation

The share of the CPI basket with inflation exceeding 2.5% has shown significant fluctuation. A peak in 2022 saw nearly 70% of the basket surpassing this threshold, driven by economic reopening and supply chain disruptions following the pandemic. Although this proportion has moderated to 50% as of November 2024, it remains elevated by historical standards, signaling the slow pace of disinflation.

Services Inflation as a Sustained Driver

A closer examination of the services sector identifies it as a persistent driver of inflation. Metrics indicate that an increasing share of services categories, such as housing, healthcare, and transportation, record price growth above 2.5%. Factors like labor intensity and long-term contracts contribute to the sector’s resistance to rapid price corrections, complicating efforts to achieve price stability.

Deflationary Trends

Deflationary forces have been minimal in recent years, contrasting with the early 2010s when technological advancements and globalization exerted downward pressure on prices. Today’s economic environment is dominated by inflationary momentum, reflecting a shift in structural and cyclical dynamics.

Policy Implications

The persistence of inflation across a broad share of the CPI basket raises concerns about the efficacy of recent monetary policy measures. The diffusion of inflationary pressures indicates a widespread challenge, particularly in services. Sticky inflation in labor-intensive sectors limits the responsiveness to short-term policy interventions, delaying the achievement of target inflation levels.

Implications for U.S. Treasury Bonds & Dollar Index

While the long-term outlook for the U.S. Treasury bonds remains bullish, sticky inflation constrains near-term performance. Market expectations around prolonged monetary tightening reduce the immediate upside potential for bond prices, keeping their performance range-bound in the short term. Also, the Dollar Index is likely to remain resilient in the short term, supported by sticky inflation and expectations of prolonged higher interest rates. However, its movement might stay range-bound due to existing pricing of monetary tightening and competitive policy moves by other central banks.

Comments are closed.