Introduction

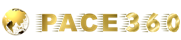

Recent data on US consumer’s health points to a troubling financial trend among American consumers. The delinquency rate on consumer loans has been sharply increasing. The consumers, particularly the bottom 50%, are extremely overstretched and over-leveraged, hampering their ability to service their loans. High prices, compared to the pre-covid levels, is also making it more difficult for people to pay their bills and also afford their loan payments. The chart below clearly highlights the sharply rising delinquencies on consumer loans.

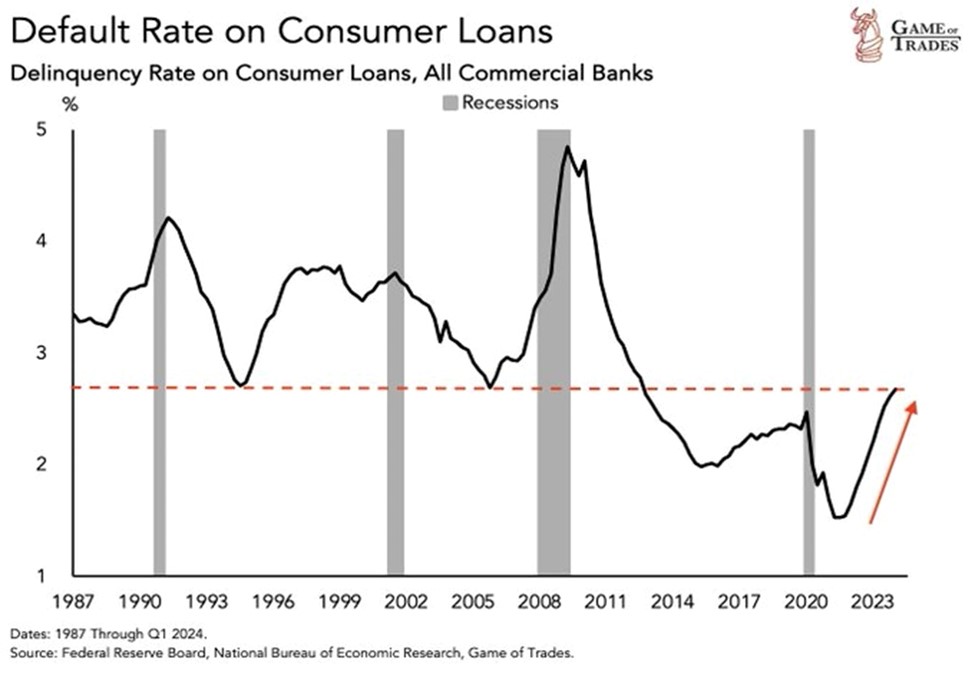

The graphs below illustrate the default rates across various age groups from 2003 to 2024, showing a significant increase in delinquencies, particularly among younger generations. Alarmingly, these rates have now surpassed their pre-pandemic levels from 2020, exacerbating the financial strain. Although this trend does not necessarily indicate an impending recession, it does suggest slower economic growth ahead, likely leading to downward revisions in earnings estimates later this year.

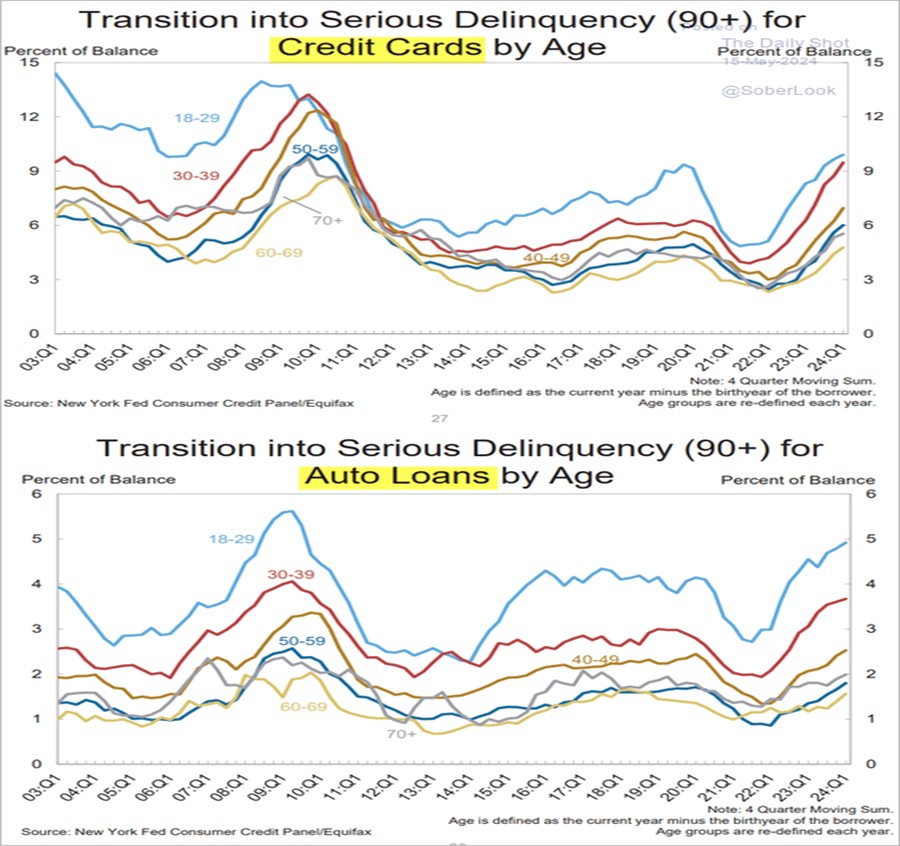

Since 2022, there have been 11 rate hikes, which have increased the federal funds rate and, consequently, credit card interest rates. Younger generations are further burdened by substantial student loan debt, leading to delayed interest payments.

Gen Z has the highest percentage of individuals maxed out on credit at 15.3%, followed by Millennials at 12.1%. Gen X has a lower percentage, with 9.6% maxed out. A recent report from the Federal Reserve Bank of New York also highlighted that Americans owe $1.12 trillion on their credit cards.

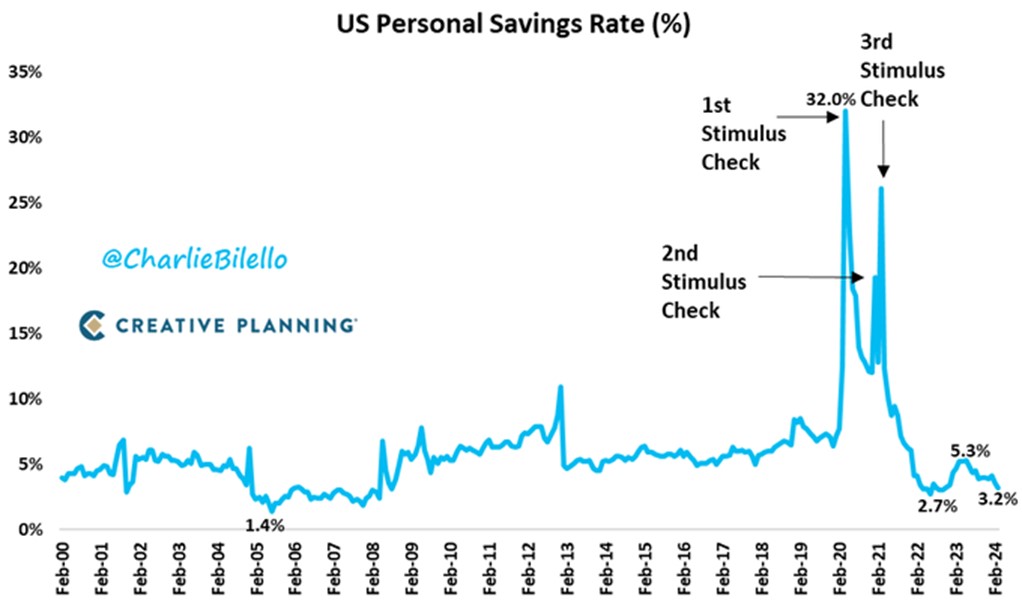

Post-pandemic, the US personal savings rate has plummeted sharply, dropping to a concerning 2.7% by the second half of 2022. Despite a slight recovery to 3.2% this year, the overall trend indicates that personal savings are on a downward trajectory, reflecting potential financial instability and decreased financial resilience among Americans.

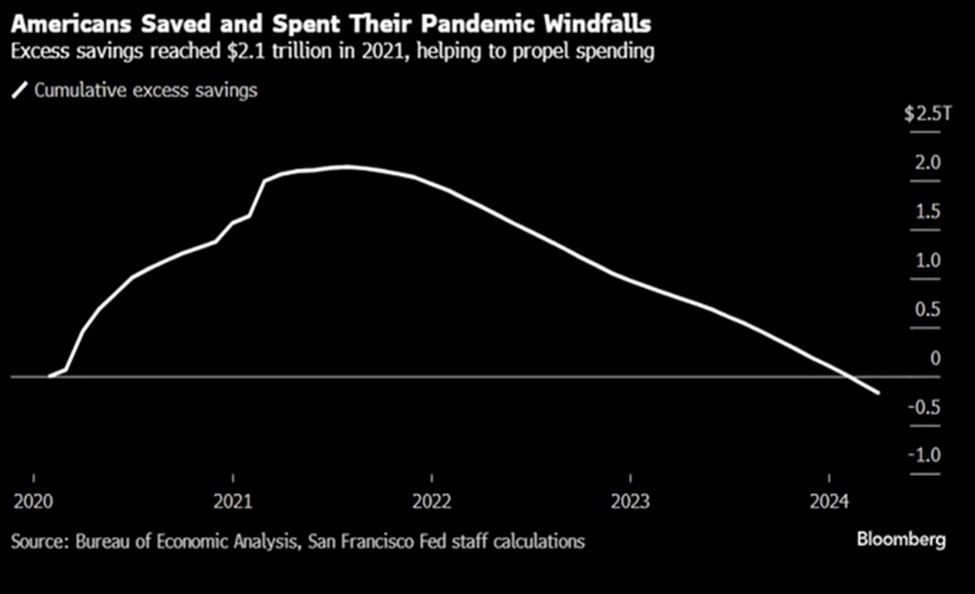

Households are not saving as much as they used to, which is evident from the low personal savings rate of 3.2%, the lowest since October 2022. This is extremely concerning, as people will not have much savings in case of a downturn, which can leave them financially vulnerable. During lockdowns, households had a lot of liquidity because of work-from-home jobs and fat stimulus checks from the government but by now those excess savings are almost completely wiped out. In fact, the bottom 50% of the households are much worse off in terms of cumulative savings than they were before the pandemic started. Also, because of Buy Now Pay Later (BNPL) services, people are spending more than they used to.

The graph below shows the cumulative excess savings reached a high of $2.1 trillion in 2021. Since then, excess savings have declined significantly. This shows that the Americans saved more money than usual during the COVID-19 pandemic, possibly due to government stimulus checks, and restrictions on travel and other activities. However, by 2024, they have largely spent down these savings.

Conclusion

The rising delinquencies on credit cards and auto loans, coupled with dwindling savings among US consumers, paint a bleak picture for the economy. These trends signify increased financial stress and instability among households, potentially leading to a downturn in consumer spending. With higher default rates, financial institutions may face greater risks, tightening lending conditions and restricting access to credit for businesses and individuals alike. Lower savings rates further diminish the cushion against economic shocks, exacerbating vulnerabilities and prolonging economic recovery periods. Last but not the least, consumer spending in the last few quarters has been underpinned by the rising wealth effect with both stocks and residential real estate at all time highs. The above prediction of less than robust consumer spending will be further accentuated if the stock indices were to fall in the near future (highly unlikely given the valuations) and the negative wealth effect kicks in. So effectively, in the best-case scenario we will have a flat line in consumer spending (barely above inflation and population growth rates) and in the worst-case scenario there could be a sharp fall which will force the US economy, and consequently much of the world, into a deep recession.

Comments are closed.