When Retail Money Meets Smart Money: The Unintended Consequences

Retail investors have emerged as a formidable force in India’s equity markets, driven primarily by the rapid growth of mutual fund investments, especially through Systematic Investment Plans (SIPs). However, this wave of domestic retail inflows is inadvertently creating exit opportunities for “smart money” investors—such as promoters, private equity funds, and multinational corporations (MNCs). As these sophisticated investors capitalize on elevated valuations and take money home, it raises concerns about the unintended consequences of uninformed retail money overshadowing foreign portfolio investments (FPIs) and inflating market valuations to potentially unsustainable levels.

Retail Money Overpowering Foreign Flows

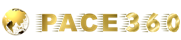

The dominance of retail investors is reshaping market dynamics, sidelining foreign investors in the process. The cumulative flows of FPIs since 2016 amounts to ₹6,565 billion, while retail mutual fund flows through SIPs amounts to ₹9,891 billion which is 1.5 times the FPI figure, driving market valuations into uncharted territory.

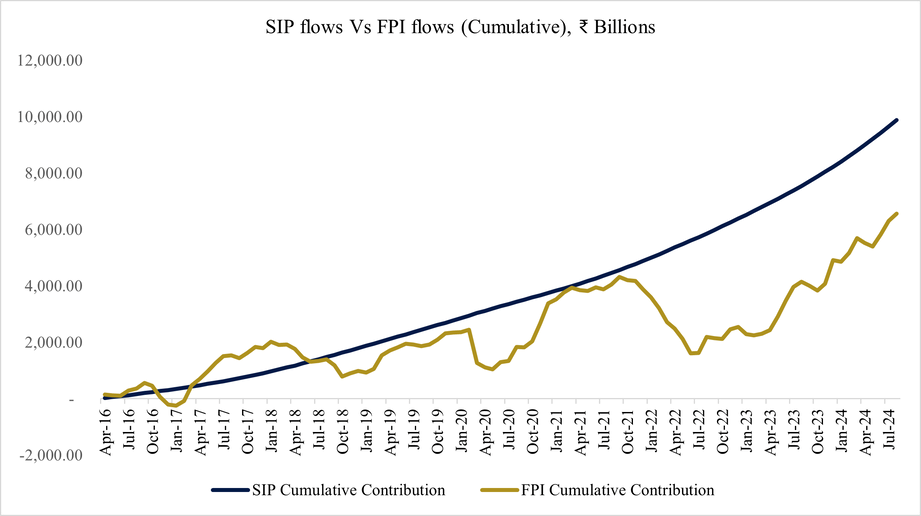

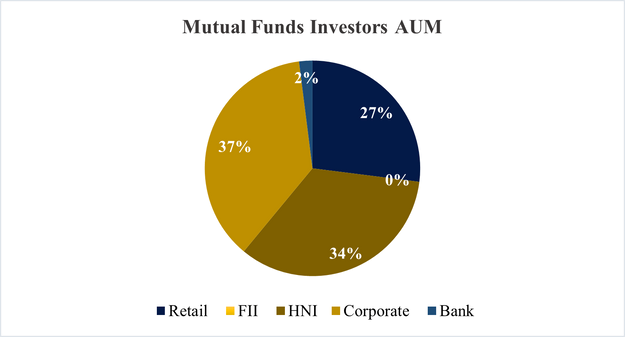

Over the past four years, retail assets under management (AUM) in the mutual fund industry have more than tripled to cross ₹17 trillion, reflecting rising investor confidence and increasing participation in mutual fund schemes. Retail investors now contribute substantially to the industry’s growth, accounting for 27% of total AUM. According to the Association of Mutual Funds of India (AMFI), as of August 2024, there were 204 million. mutual fund accounts, 80% of which belonged to retail investors. The total number of retail investors in mutual funds is now about 40 million. Although institutional investors (HNIs, corporates, and banks) still hold a larger share, the retail investors have an outsized presence in equities and through equity SIPs are the main contributing factor behind rapid rise in equity assets and clout of the Indian mutual fund industry.

Apart from the mutual funds route retail investors also invest in stocks directly through their demat and broking accounts. The number of demat accounts as of August 31, 2024, stands at 171 million; of which 133 million are with CDSL and 38 million demat accounts are with NSDL.

The total retail ownership by value has surged from ₹8 trillion in March 2020 to ₹63 trillion, while FPI ownership currently stands at ₹78 trillion. This retail investments in mutual funds and the increasing retail participation—fueled by digitization of trading and investing apps and easier access to financial products—has shifted the entire landscape of the Indian capital markets. Despite their growing influence, many retail investors lack a full understanding of the risks associated with high valuations and market cycles, creating a precarious situation where they may be left holding overpriced assets as seasoned investors exit. At a macro level, it raises concerns about inefficient capital allocation and inflated asset prices, which could lead to market and even imbalances.

Retail Flows: A Floodgate for Smart Investor Exits

The scale of retail inflows has been staggering. Retail investors have injected ₹9,891 billion into the market via SIPs since 2016, significantly outpacing the ₹6,565 billion contributed by FPIs during the same period. This retail-driven liquidity has provided an opportune exit window for institutional and strategic investors, who have been offloading stakes at attractive valuations, riding the wave of retail enthusiasm.

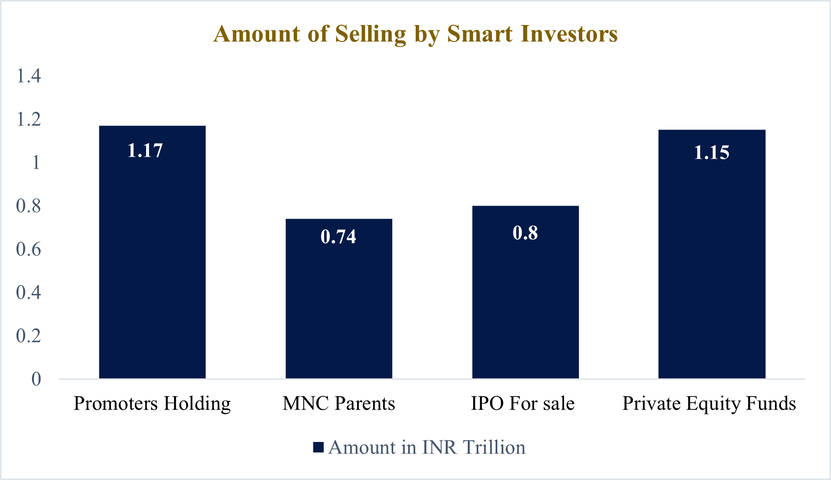

In the last 15 months:

- Indian promoters have sold over ₹1.17 trillion in equity, including ₹0.82 trillion in FY24 and ₹0.35 trillion in Q1 FY25—marking a sharp increase from ₹0.45 trillion in FY23.

- MNC parents have offloaded ₹0.74 trillion worth of stakes, up from just ₹0.12 trillion crore in FY23.

- Private equity funds have exited stakes worth ₹1.15 trillion during this period. These figures underscore a clear trend: retail investors are fueling an environment where sophisticated investors are locking in profits. Selling by Smart Investors in the Past 15 months.

Case Studies: Retail Money Facilitating Smart Investor Exits

Several high-profile transactions highlight how retail inflows are facilitating exits for seasoned players:

- Whirlpool Corporation (February 2024):

- Whirlpool sold a 24% stake in its Indian subsidiary, Whirlpool of India, to domestic mutual funds for $468 million.

- Buyers: SBI Mutual Fund, ICICI Prudential MF, DSP MF, Nippon India MF, and Aditya Birla Sun Life MF.

- Outcome: Whirlpool reduced its stake from 75% to 51%, capitalizing on domestic retail flows and high valuations. The company’s management described the move as a “basic arbitrage” opportunity, exploiting the Indian market’s 50x multiples compared to lower valuations at the parent level.

- British American Tobacco (March 2024):

- Sold a 3.5% stake in ITC, valued at ₹174 billion, reducing its holding to 25.5%.

- Buyer: Institutional investors via an accelerated bookbuild process.

- Timken Singapore (May 2024):

- Timken’s Singapore arm divested a 6.6% stake in Timken India for ₹19.56 billion.

- Buyers: Axis MF, Nippon India MF, UTI MF, HDFC Life, among others.

- Result: Timken’s stake dropped from 57.7% to 51.06%, while institutional holdings surged by 7.43%.

- Tencent (August 2024):

- Tencent sold a 2.1% stake in PB Fintech (Policy bazaar), raising ₹16.68 billion.

- Buyers: SBI MF, Axis MF, Mirae Asset MF, and Goldman Sachs

- The sales lowered Tencent’s stake from 4.26% to 2.13%, taking advantage of strong retail-driven performance..

Private Equity Funds: Capitalizing on Retail Liquidity

Private equity funds have been major beneficiaries of retail inflows, using the equity market’s strength to exit significant stakes. In the past 15 months, PE funds have divested stakes worth ₹1.15 trillion. Noteworthy exits include:

- Blackstone’s sale of Mphasis: A 15.1% stake was sold via block deals, raising ₹67.36 billion at ₹2,363 per share, with buyers including Kotak MF, Morgan Stanley, and Société Générale.

- Warburg Pincus’ exit from Kalyan Jewelers: Warburg sold a 6.45% stake for ₹35.84 billion through block deals, with key buyers being Nomura, the Government of Singapore, and Motilal Oswal MF.

- Bain Capital’s exit from Axis Bank: Bain sold its remaining 1% stake for ₹35.74 billion in FY24, following earlier sales in L&T Finance and Apollo Tyres.

IPOs: Smart Money Cashing Out

The IPO market has also become a vehicle for exits, with 91 IPOs raising ₹0.80 trillion in the last 15 months. Notably, two-thirds of these IPOs were “offers for sale” (OFS), allowing private equity investors and promoters to cash out rather than raising capital for growth.

The IPO pipeline remains robust, with another ₹0.93 trillion worth of offerings in the coming months. A significant portion of these will be exits for private equity players and promoters, with pre-IPO locked-in shares of the 91 recent IPOs also coming to market soon.In essence, retail investors, driven by optimism and long-term goals, inadvertently create an exit opportunity for seasoned investors who understand valuations and market cycles.

Institutional players and smart money can utilize these constant liquidity flows to rebalance portfolios and book handsome profits without reducing the stock price or disrupting the market, as retail buying activity keeps demand strong.

Unintended Consequences and the Way Forward

The overwhelming influx of retail money into Indian equities is creating lucrative exit opportunities for seasoned investors, often at the expense of uninformed retail participants. With market valuations continuing to soar, the risk of a correction is mounting.

To mitigate these unintended consequences, there must be a concerted effort to:

- AMFI’s “Mutual Funds Sahi Hai” campaign: While, it has been pivotal in promoting mutual fund and SIP investments, its focus has been more on participation rather than imparting deeper financial education.

- Enhance Financial Literacy: Campaigns should focus on market risks, valuation discipline, and long-term investment strategies.

- Strengthen the Advisory Ecosystem: India has a limited number of registered investment advisors (RIAs). SEBI should incentivize the growth of professional advisory services to guide retail investors.

Conclusion

While retail money is fueling a bull run in Indian markets, it is also creating exit opportunities for smart investors. The absence of strong financial literacy among retail investors is a pressing concern. Without addressing the education gap, retail investors may find themselves over invested in equities at unjust valuations and at the wrong time in a macro cycle, potentially risking the financial future of an entire generation of Indian investors and also exacerbating the macro-imbalances in the Indian financial markets and the economy.

Comments are closed.